- Dịch vụ khác (7)

- Wordpress (33399)

- Plugin (8229)

- Apps Mobile (364)

- Codecanyon (4158)

- PHP Scripts (763)

- Plugin khác (2537)

- Whmcs (67)

- Wordpress.org (340)

- Theme (25170)

- Blogger (2)

- CMS Templates (545)

- Drupal (3)

- Ghost Themes (3)

- Joomla (19)

- Magento (2)

- Muse Templates (37)

- OpenCart (19)

- PrestaShop (9)

- Shopify (1143)

- Template Kits (6309)

- Theme khác (379)

- Themeforest (7444)

- Tumblr (1)

- Unbounce (3)

- Website & Html Templates (9252)

- Admin Templates (840)

- Email Templates (228)

- Site Templates (7701)

- Plugin (8229)

WooCommerce Taxamo

1.911.800₫ Giá gốc là: 1.911.800₫.382.360₫Giá hiện tại là: 382.360₫.

Handle EU VAT calculations using Taxamo’s VAT calculation service.

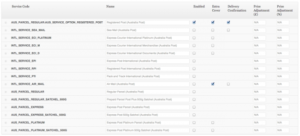

Taxamo Version 2 (API) is now supported:

The latest version of this plugin supports the API v2. Please ensure your account with Taxamo supports the API v2 before upgrading. If you are unsure, please ask Taxamo, otherwise please don’t upgrade or buy this plugin until your Taxamo account supports it.

Connect your store to Taxamo, a popular EU VAT calculation service, and be compliant with the 2015 EU VAT regulations. WooCommerce will send the shopping cart information to Taxamo when your customer is at the checkout and will return the appropriate EU taxes for the digital goods in their cart.

WooCommerce Taxamo also handles evidence collection and registration of payments.

Whether you’re selling digital downloads, eBooks or other such digital goods, Taxamo will return the appropriate tax rates to WooCommerce, based on the customer’s location and the products in their cart.

The extension uses Taxamo’s API for correct TAX calculation, evidence collection and registration of payments. Taxamo comprehensive reporting tools generate downloadable EU MOSS returns and audit files.

What is Taxamo?

Taxamo is an end-to-end service which calculates the appropriate EU VAT rates based on your customer’s location and the products within their cart. Taxamo can capture up to 6 pieces of location evidence in a single transaction, all in real-time and all without interrupting the existing customer journey.

Taxamo creates EU MOSS settlement returns and audit-ready reports. Taxamo also offers 1-1 technical, multichannel support to anyone who uses the WooCommerce plugin.

What is VATMOSS?

VATMOSS is an EU VAT regulation, effective January 1st 2015. This new regulation requires that VAT for the sale of digital goods be charged based on the location of the customer (rather than the location of the online store) as well as factoring in different rates depending on the type of digital goods (for example, an eBook sold to someone in France has a different cost to a digital download sold to a customer in France).

The payments are made to a MOSS (mini-one-stop-shop) registered in the EU. This is then collected by the appropriate government department.

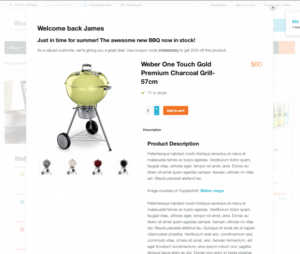

Tặng 1 theme/plugin đối với đơn hàng trên 140k:

Flatsome, Elementor Pro, Yoast seo premium, Rank Math Pro, wp rocket, jnews, Newspaper, avada, WoodMart, xstore

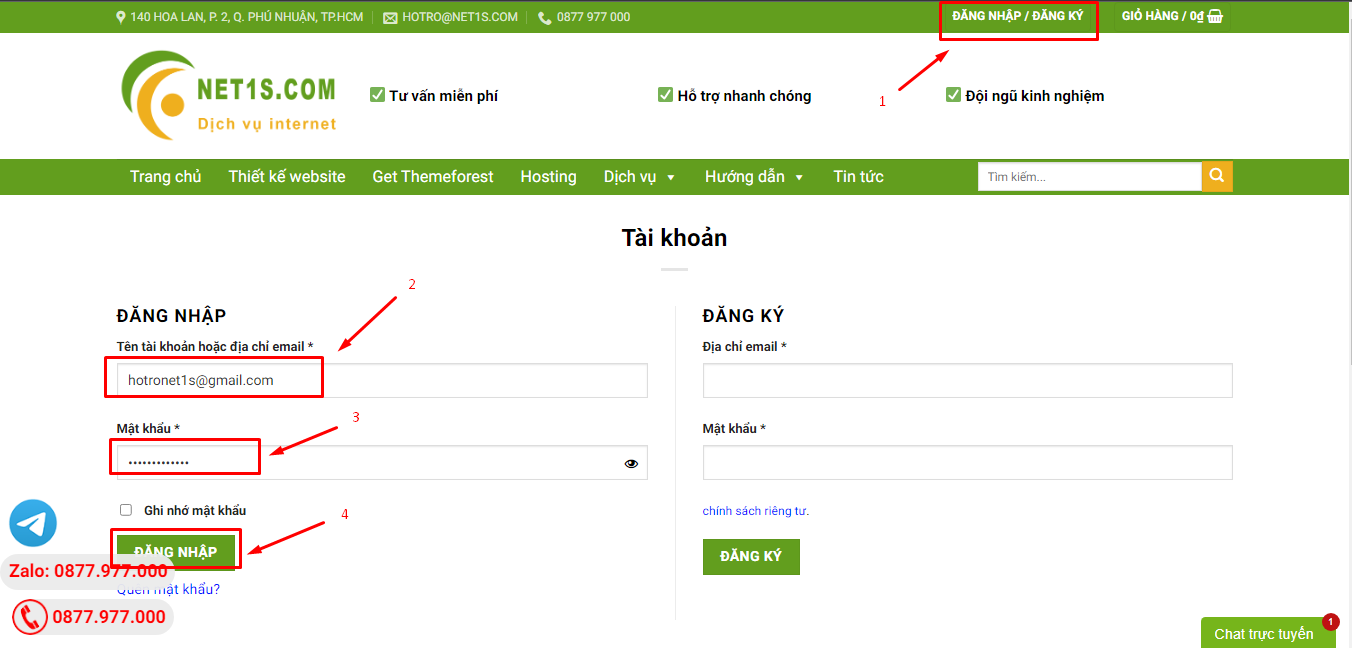

1. Bấm Đăng nhập/đăng ký.

2. Điền thông tin email, mật khẩu đã mua hàng -> bấm Đăng nhập.

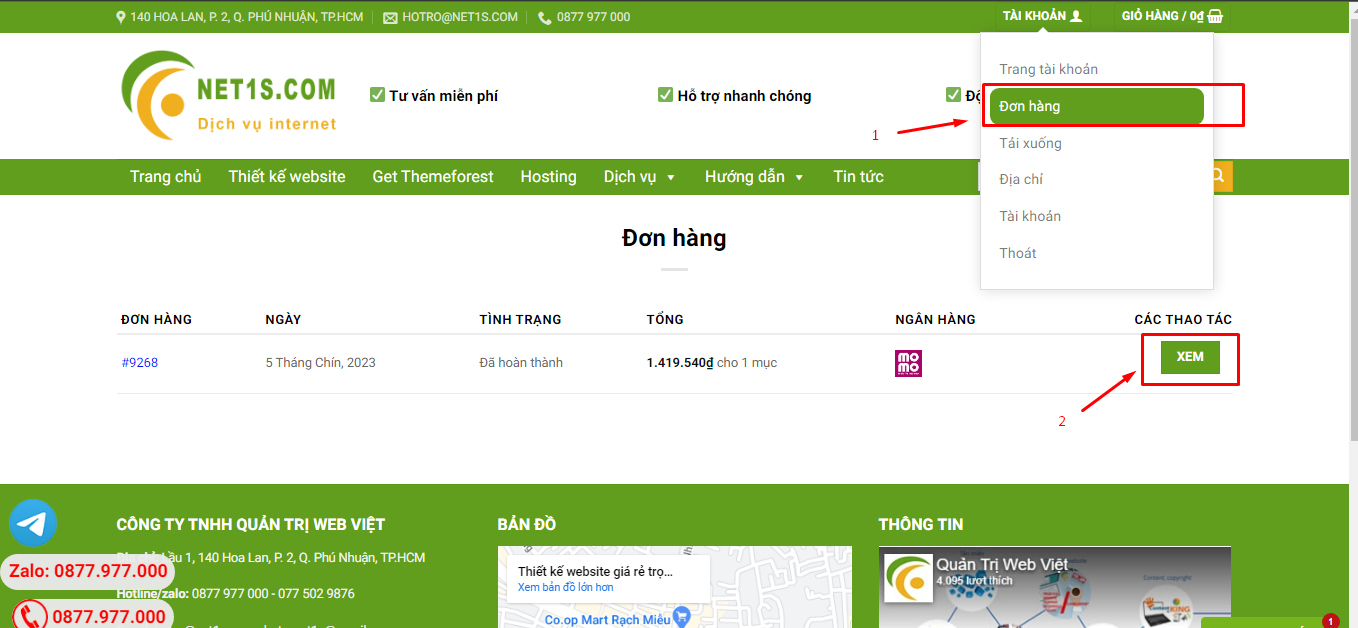

3. Di chuột đến mục Tài khoản -> Đơn hàng -> bấm vào Xem ở đơn hàng đã mua.

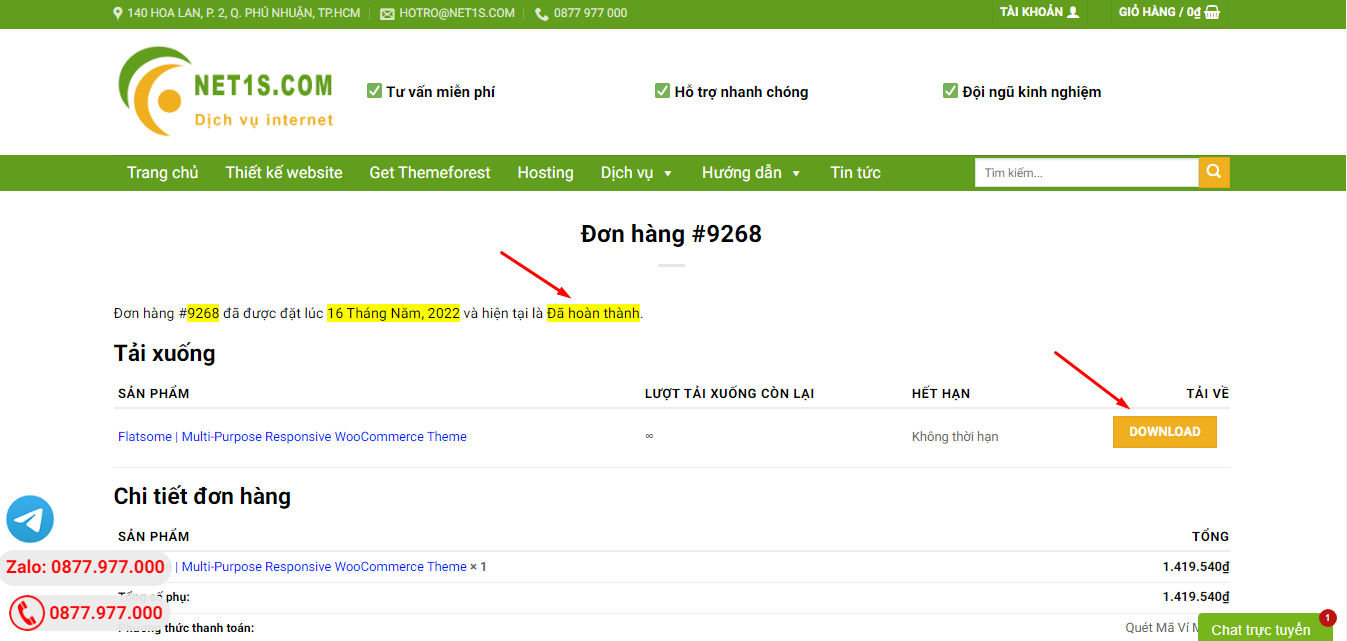

4. Đơn hàng hiển thị tình trạng Đã hoàn thành -> bấm vào Download để tải sản phẩm về.

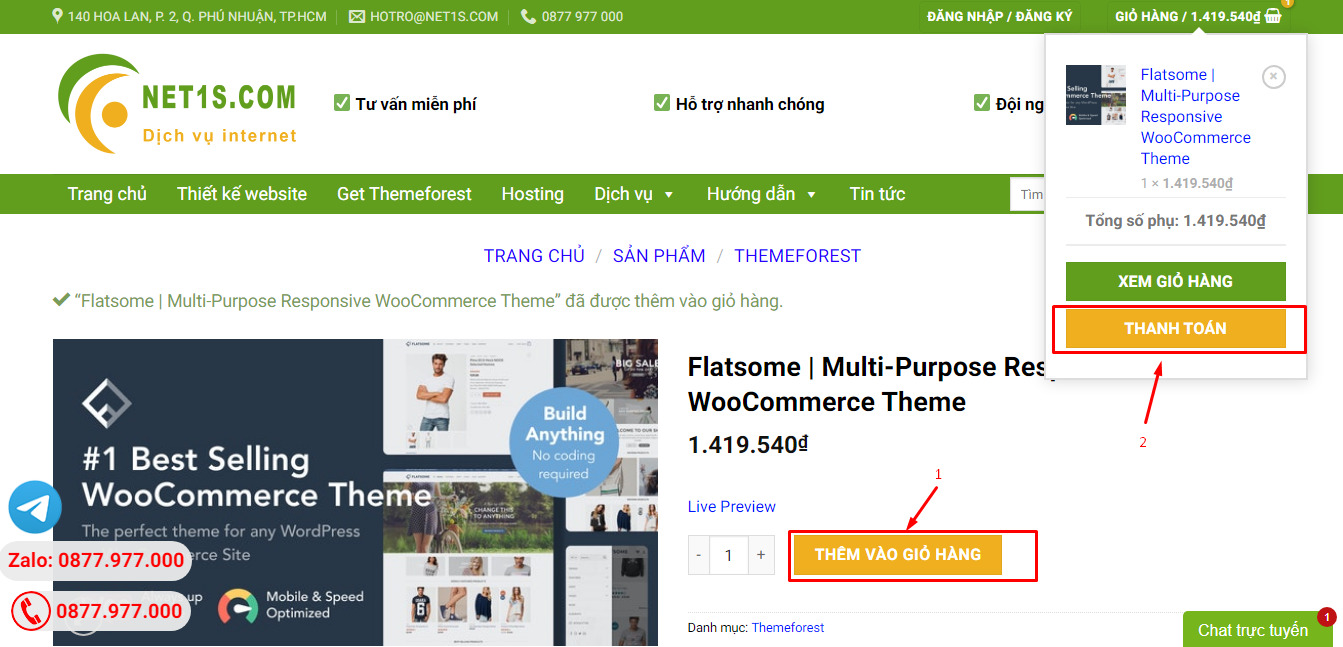

1. Bấm Thêm vào giỏ hàng -> bảng thông tin giỏ hàng sẽ hiển thị góc trên bên phải.

2. Bấm Thanh toán.

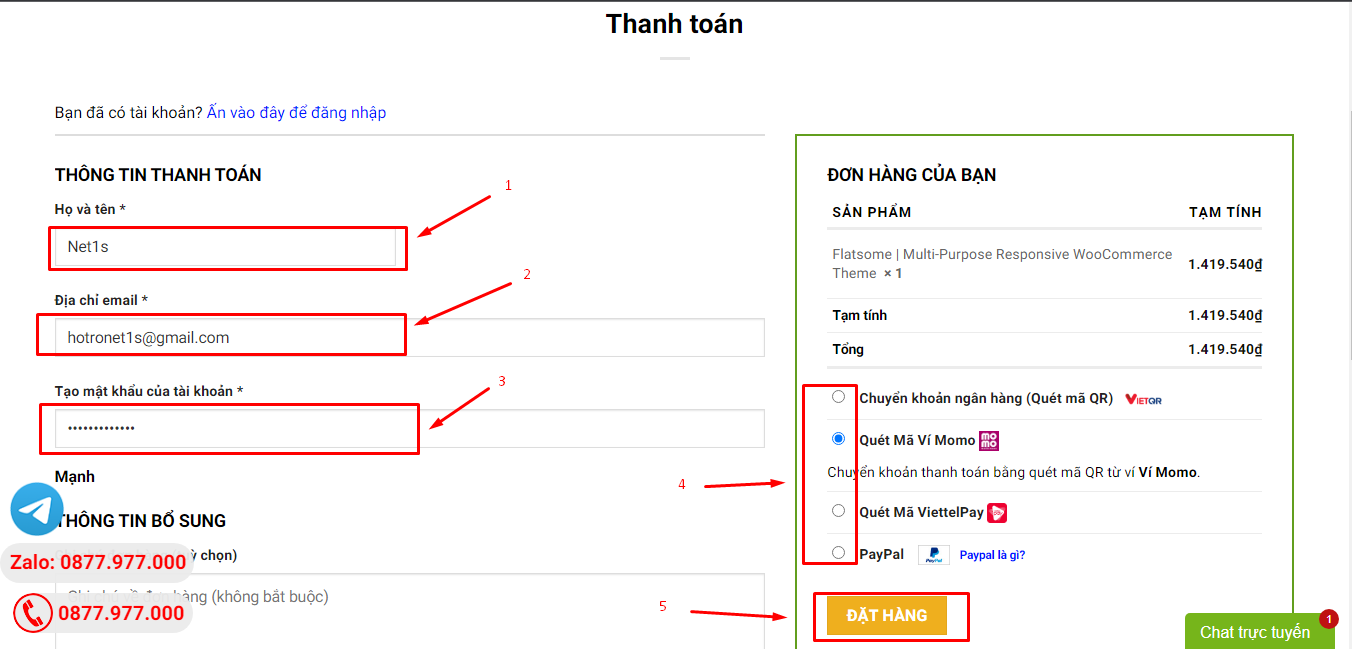

3. Điền thông tin thanh toán gồm: tên, email, mật khẩu.

4. Chọn phương thức thanh toán có hỗ trợ gồm: Chuyển khoản ngân hàng (quét mã QR), quét mã Momo, quét mã Viettelpay, Paypal.

5. Bấm Đặt hàng để tiếp tục.

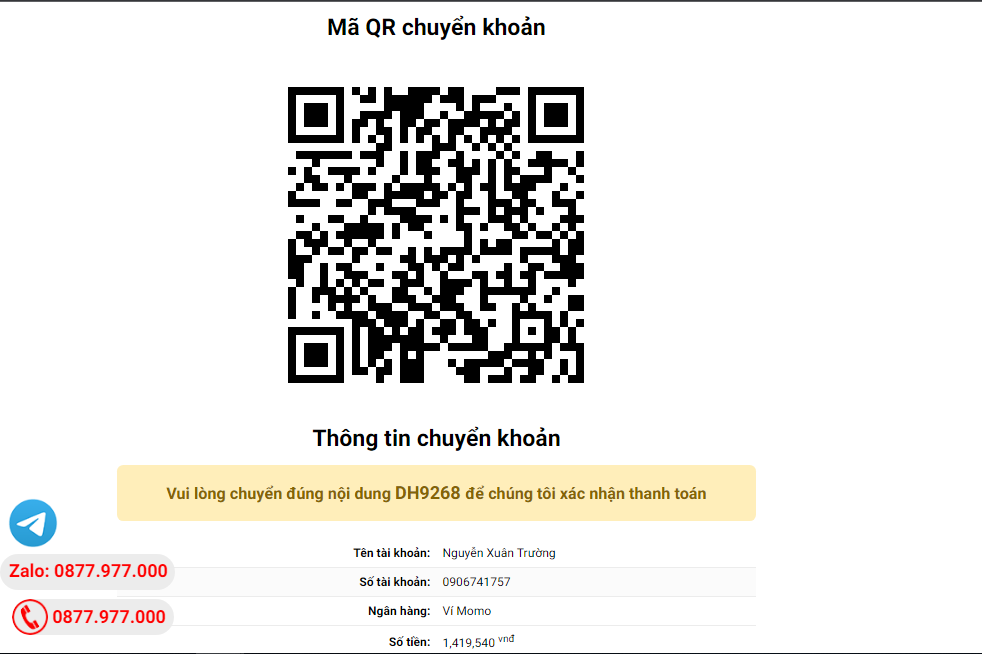

5. Thanh toán bằng cách quét mã QR (Nội dung chuyển khoản và số tiền sẽ tự động được tạo), hoặc chuyển khoản nhập số tiền và nội dung chuyển khoản như hướng dẫn.

6. Sau khi thanh toán xong đơn hàng sẽ được chúng tôi xác nhận đã hoàn thành và bạn có thể vào mục Đơn hàng để tải sản phẩm đã mua về.