- Dịch vụ khác (7)

- Wordpress (33388)

- Plugin (8229)

- Apps Mobile (364)

- Codecanyon (4158)

- PHP Scripts (763)

- Plugin khác (2537)

- Whmcs (67)

- Wordpress.org (340)

- Theme (25159)

- Blogger (2)

- CMS Templates (545)

- Drupal (3)

- Ghost Themes (3)

- Joomla (19)

- Magento (2)

- Muse Templates (37)

- OpenCart (19)

- PrestaShop (9)

- Shopify (1143)

- Template Kits (6307)

- Theme khác (379)

- Themeforest (7443)

- Tumblr (1)

- Unbounce (3)

- Website & Html Templates (9244)

- Admin Templates (839)

- Email Templates (228)

- Site Templates (7694)

- Plugin (8229)

PayPal Payments

2.141.340₫ Giá gốc là: 2.141.340₫.428.268₫Giá hiện tại là: 428.268₫.

See how to activate PayPal

New to PayPal? Learn how to add your store.

Need to update your existing PayPal? Learn how.

Watch the how-to video.

Our all-in-one checkout solution*

PayPal Payments lets you offer PayPal, Venmo (US only), Pay Later options and more — all designed to help you maximize conversion.

PayPal

Help increase conversion by automatically offering PayPal buttons on product pages and at checkout. Consumers are nearly three times more likely to purchase when you offer PayPal.1

PayPal Pay Later

Let customers pay over time while you get paid up front — at no additional cost. PayPal’s pay later options are boosting merchant conversion rates and increasing cart sizes by 39%.2

Venmo (US only)

Reach Venmo shoppers while allowing customers to share purchases with friends. Venmo users spend 2.2 times more annually on online purchases compared to other online buyers.3

Country-specific payment methods

Offer locally recognized payment methods to help build trust and reach international customers, including Payment Upon Invoice (PUI), a local payment option available only for purchases completed in Germany.

Help increase conversions with Pay Later messaging

PayPal Pay Later allows customers to pay over time while you get paid up front — at no additional cost to your business. And since 81% of younger consumers who use buy now, pay later decide which payment method to use before they get to checkout4, showing Pay Later messaging on your site lets customers know they have flexible options to pay over time while they are browsing — helping convert your browsers into buyers.

Available in these countries:

Add credit and debit card processing capabilities

PayPal Payments provides two different card processing options on WooCommerce:

Standard Card ProcessingCard transactions are managed by PayPal in a prebuilt user experience, which simplifies your compliance requirements. Suitable for all business and personal seller accounts. |

|

Advanced Card ProcessingGet everything that comes with PayPal’s standard integration, along with the ability to customize the look, feel, and placement of your debit and credit card payment fields. You can also use fraud protection tools to set up your own risk tolerance filters. |

Activate PayPal

See how to activate

More reasons it pays to PayPal

Instant access to fundsAccess card payments, send money or make a payment from your bank account. You’re credited immediately while the payment is processing. Funds settle instantly into your PayPal business account. |

|

Fraud DetectionSave time and money by letting PayPal help you handle the risk of fraudulent transactions with our fraud, chargeback, and Seller Protection capabilities (on eligible transactions†). Our AI technology works hard to monitor all of your transactions — so you can focus on what matters most.†Available on eligible purchases. Limits apply. |

|

Global compliancePayPal payment solutions help you meet your global compliance standards, such as PCI and PSD2, bringing international markets within reach for your business. Our platform has built-in compliance with two-factor authentication provided by cards (3D Secure). We include automatic updates as security protocols change. |

Legal Disclosures:

*For Australian users, the PayPal service is provided by PayPal Australia Pty Limited AFSL 304962. Any information provided is general only and does not take into account your objectives, financial situation or needs. Please read and consider the CFSGPDS (paypal.com.au) before acquiring or using the service. See website for TMD.

1 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

2 PayPal Q2 Earnings-2021.

3 Edison Trends, commissioned by PayPal, April 2020 to March 2021. Edison Trends conducted a behavioural panel of email receipts from 306,939 US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during a 12-month period.

4 TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among Millennial & Gen Z BNPL users (ages 18-40), US (n=222), UK (n=269), DE (n=275), AU (n=344), FR (n=150).

5 Morning Consult – The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.

Tặng 1 theme/plugin đối với đơn hàng trên 140k:

Flatsome, Elementor Pro, Yoast seo premium, Rank Math Pro, wp rocket, jnews, Newspaper, avada, WoodMart, xstore

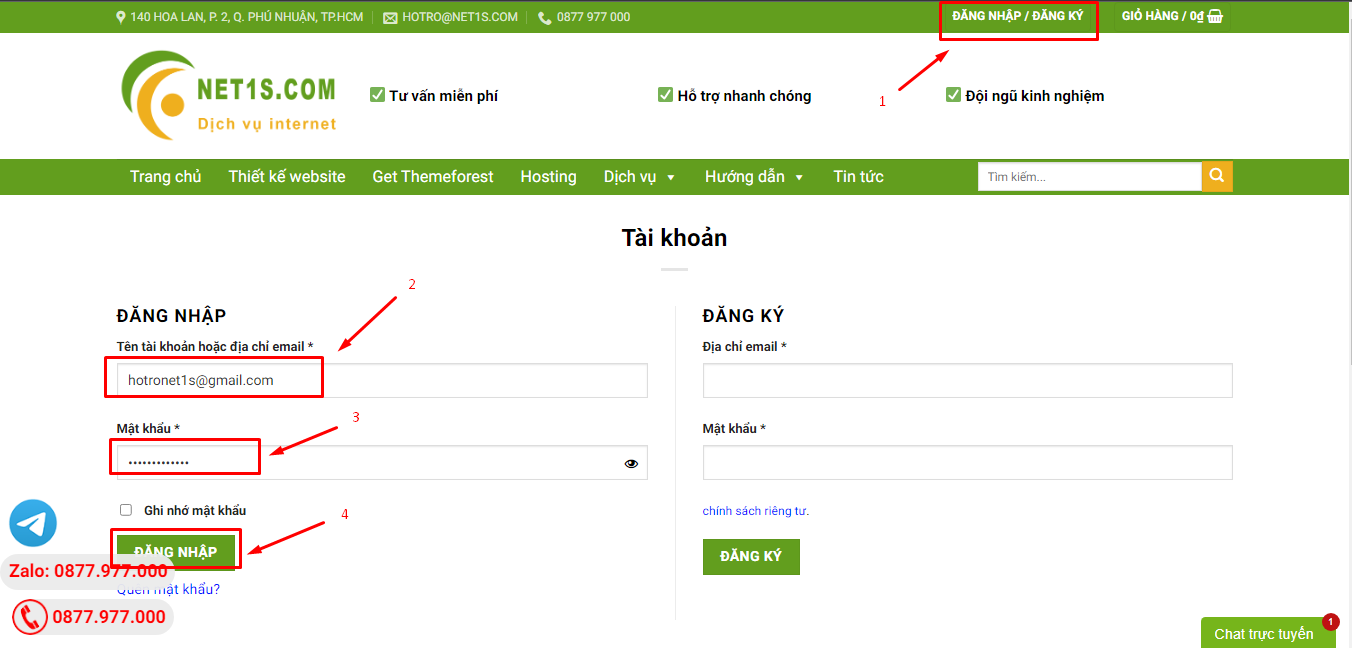

1. Bấm Đăng nhập/đăng ký.

2. Điền thông tin email, mật khẩu đã mua hàng -> bấm Đăng nhập.

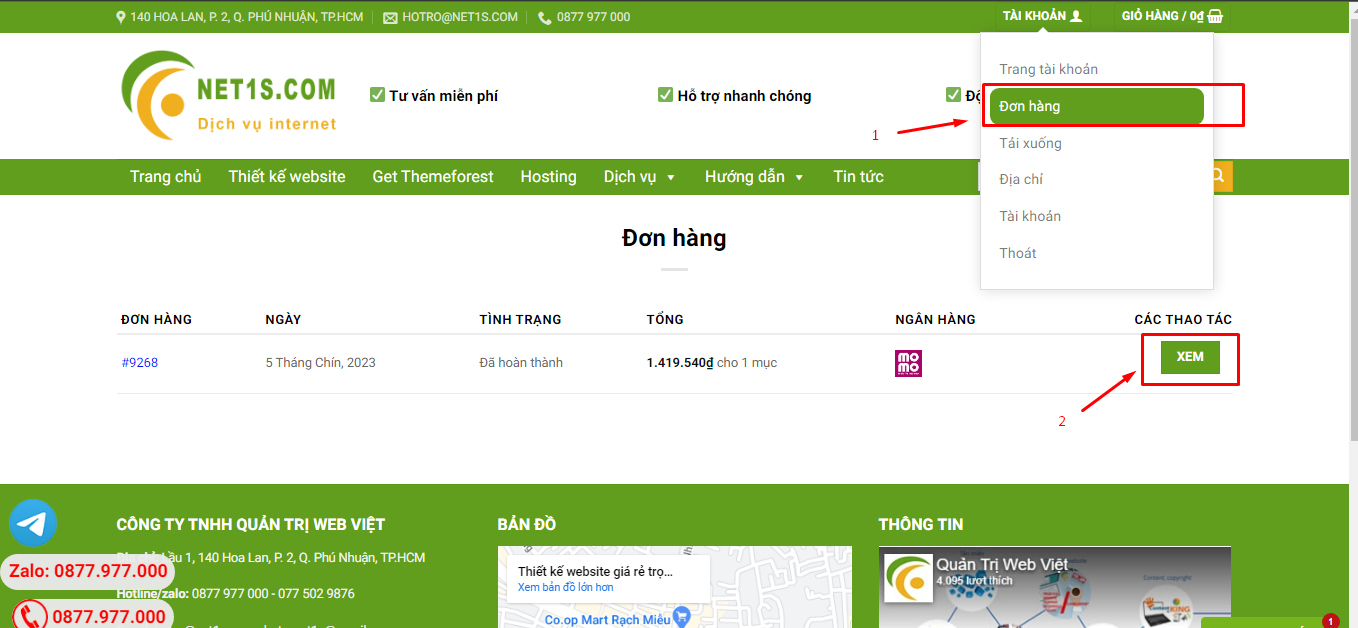

3. Di chuột đến mục Tài khoản -> Đơn hàng -> bấm vào Xem ở đơn hàng đã mua.

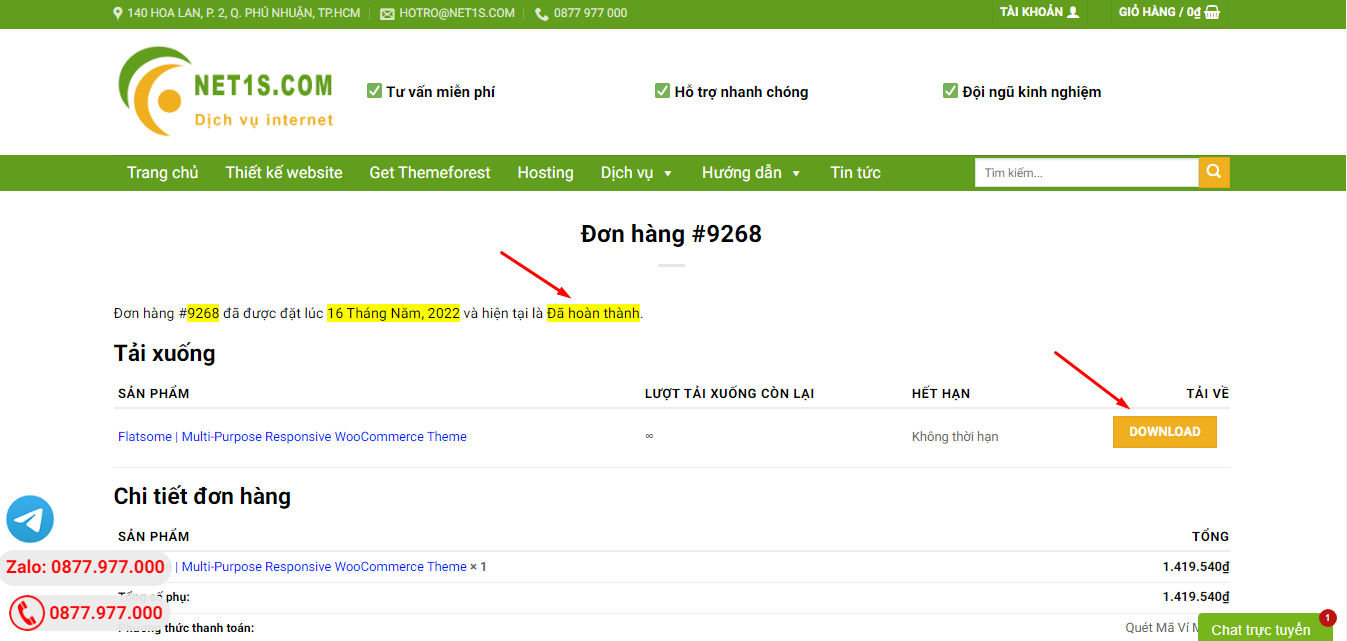

4. Đơn hàng hiển thị tình trạng Đã hoàn thành -> bấm vào Download để tải sản phẩm về.

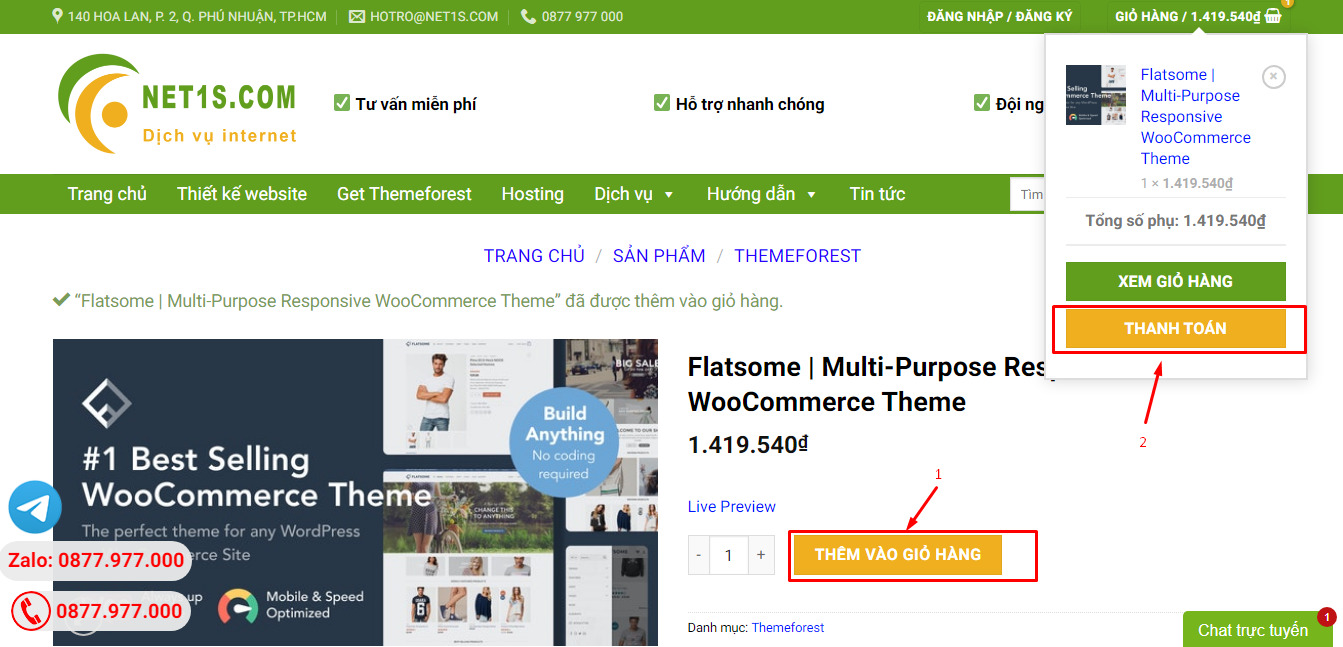

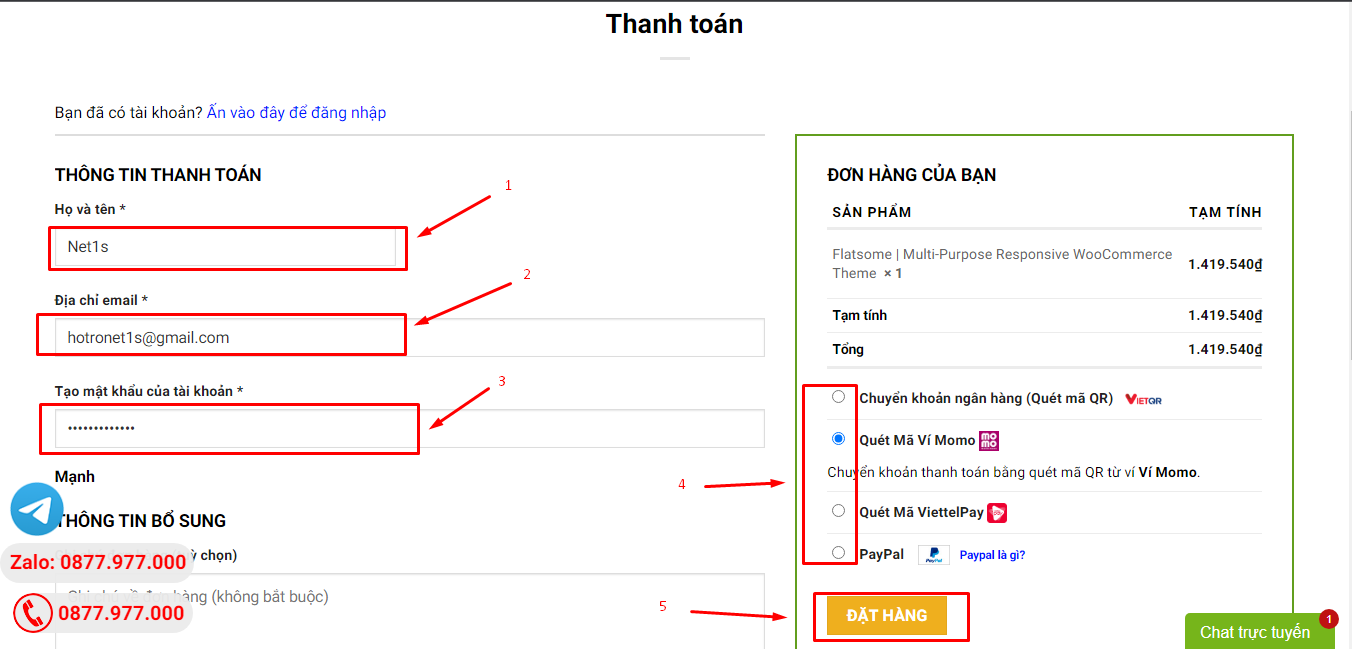

1. Bấm Thêm vào giỏ hàng -> bảng thông tin giỏ hàng sẽ hiển thị góc trên bên phải.

2. Bấm Thanh toán.

3. Điền thông tin thanh toán gồm: tên, email, mật khẩu.

4. Chọn phương thức thanh toán có hỗ trợ gồm: Chuyển khoản ngân hàng (quét mã QR), quét mã Momo, quét mã Viettelpay, Paypal.

5. Bấm Đặt hàng để tiếp tục.

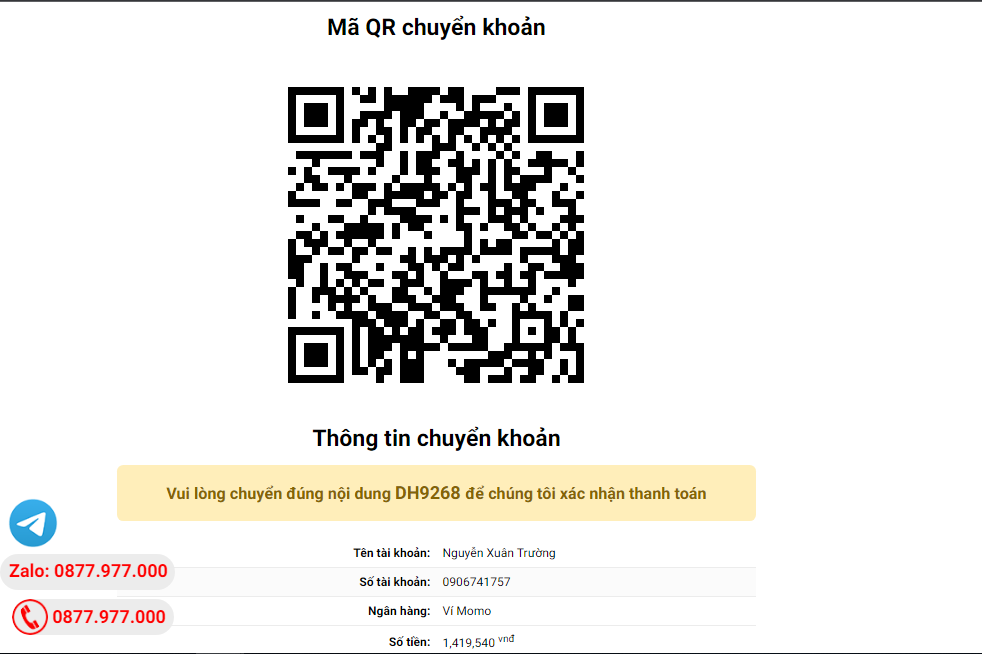

5. Thanh toán bằng cách quét mã QR (Nội dung chuyển khoản và số tiền sẽ tự động được tạo), hoặc chuyển khoản nhập số tiền và nội dung chuyển khoản như hướng dẫn.

6. Sau khi thanh toán xong đơn hàng sẽ được chúng tôi xác nhận đã hoàn thành và bạn có thể vào mục Đơn hàng để tải sản phẩm đã mua về.